The June 2022 mortgage rate spike increases homebuyer monthly payments, but it’ll also slow red hot bidding wars that drive up home prices. So focused homebuyers will find deals this summer, and they need your help. Below we discuss what the home sales and mortgage rate outlook means for home buyers. And we also cover three ways you as a lender can help homebuyers win deals in summer 2022.

The Fed’s Inflation Battle Is Painful, But It’s Working

Battling inflation creates a worst case scenario for people. All consumers hate higher prices on food, gas, and goods; and also hate that the Fed is making borrowing costs higher. Headlines scream of recession threats, and the economy is indeed slowing. But make no mistake: a slower economy is the Fed’s goal.

You quell inflation by slowing demand, and the Fed is raising rates to slow demand. This is a critical, counterintuitive point that we – and the consumers we serve – rarely hear in media inflation hype. The “headline” inflation consumers mostly hear about is the Consumer Price Index (CPI), which peaked in May at 8.6% annualized on June 10. Mortgage bonds then sold sharply, sending rates up into the low to mid-6% range, and the Fed sped up their hiking of overnight bank-to-bank lending rates to slow inflation.

Next up the Fed will watch whether their preferred inflation measure rises or stabilizes. This measure is the “Core” Personal Consumption Expenditures (PCE) index, which excludes highly volatile food and energy prices. Core PCE inflation peaked in February at 5.3%, dropped to 4.9% annualized when the March reading was released May 27, and the May reading will be released June 30. So the Fed’s preferred inflation measure is still well above their 2-3% target, but this year’s rate spike – intentionally induced by the Fed to combat inflation – could level off if Core PCE inflation also levels off in the coming months.

Finally, Mortgage & Housing Signals Improve For Homebuyers

At the low-to-mid 6% range now, mortgage rates are up 3.25% from record lows in December 2021. While quite jarring in a six-month context, the Mortgage Bankers Association (MBA) still projects lenders will make about 4.5 million loans to homebuyers this year, down only slightly from 4.8 million home purchase loans last year. And here are other key signals that can provide relief for homebuyers if these trends hold while the Fed’s inflation battle plays out:

- Home price increases of 17.6% last year are expected to drop to 2.7% this year, per MBA, which means bidding wars would subside.

- Plus, it’s notable that higher home prices didn’t deter first time homebuyers in 2021.

- Sales of new homes, which account for about 12% of yearly U.S. home sales, rose 10.7% from April to May 2022, but are down 10.6% in 2022 so far. If this continues, it can create more available buyer inventory and lower prices.

- Sales of existing homes, which account for about 88% of yearly U.S. home sales, have dropped in four straight months.

- U.S. homebuyers are still in bidding wars on 58% of deals, but this number is dropping along with home sales numbers so far.

- Inventory is still very constrained, but HouseCanary reports that, if the conditions above persist, the inventory picture could improve in 2H22.

3 Ways Lenders Can Help Homebuyers Win Deals In Summer 2022

It’s important to note that the MBA outlook for lenders to make 4.5 million purchase loans in 2022 accounts for all the current market factors above. To capture these purchase units in 2022, here are three ways you as a lender can help homebuyers.

1. Reset Your Purchase Pre-Approval Mindset & Pipeline

Homebuyers are slow to absorb rate shocks, and headlines about recession threats only make them hold out for 3.x% rates even more. This means many home shoppers you pre-approved in late-2021 or early-2022 are still holding out for lower rates that may never come.

Here are a few tips for dealing with this:

- If these buyers start shopping you, remember that for every one who leaves you, you’ll gain one who leaves another lender.

- Remind buyers that if home price appreciation is slowing from 17.6% last year to 2.7% this year, this is their best chance in years to get a deal on the purchase price.

- Then it’s easy to refi into a lower rate if rates come down.

Note that Goldman Sachs currently predicts Core PCE will drop from 4.9% now to 2.3% by December 2023. If this happens, rates would also moderate, creating opportunity to refi recently closed homebuyers.

2. Respond To Homebuyer Intent In Real Time

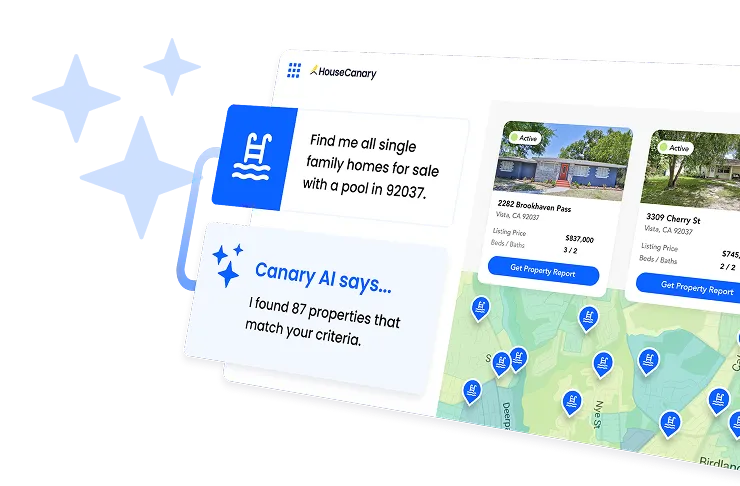

In this noisy headline market cycle, homebuyers need real-time analytics, advice, and engagement to keep up – and to remain loyal to you as their lender. We all know homebuyer (and owner) search and engagement tools like HouseCanary’s ComeHome are perfect for this. But what struck me in my recent conversation with ComeHome product head Chris Rediger was how much he gets your ground game:

Whatever tech you use to engage your buyers with analytics and advice better be real-time relevant for buyers, and deliver leads and updates straight to your loan officers (LOs). As budgets tighten, Chris gets the need for standing up a tool like ComeHome in days, not months to let homebuyers search for homes and connect with LOs immediately.

Below is a new, summer 2022 feature Chris showed me where:

- Your customers run their home search on ComeHome’s world class desktop site or mobile app

- You show your customers Google Display Ad-quality promos right in their ComeHome experience

- And you can customize these promos in real-time with promo copy, links, and link destinations

- It’s all about identifying people who are ready to act, and having their actions hit loan officers directly.

- It can be up and running immediately by using ComeHome directly. And of course it can be integrated into your chosen marketing system now or later.

If you’re interested in learning more, schedule some time here with a ComeHome expert.

End Pre-Approved Homebuyer Fallout

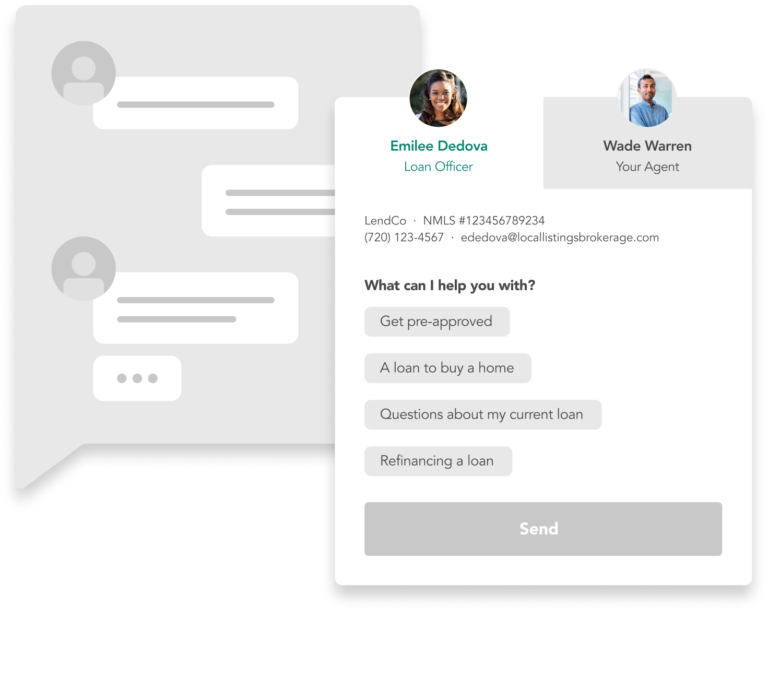

Another new, summer 2002 ComeHome feature Chris showed me was My Team, which retains pre-approved homebuyers by letting them connect with you or your realtor immediately.

ComeHome By HouseCanary – “Have Questions” Displays “My Team”

As we know, pre-approved buyer fallout comes from fatigue and uncertainty, here are a few reasons this kind of homebuyer tool is critical right now:

- Homebuyers stay plugged in to their local market – then ping you and your real estate agent for help in real-timeHomeowners who may sell-then-buy can truly understand their outgoing equity within 2.5% accuracy

- You can also use ComeHome to vet each property per offer so your pre-approval letters (and briefings for buyer and seller agents) can be stronger

Take Action On Your 2022 Homebuyer Playbook

I know it’s been bumpy out there as pipelines slow, headlines confuse or mislead your customers, and you must constantly refresh purchase pre-approvals for every offer.

Please contact the ComeHome team if you have any questions on this market outlook or purchase pro tips.