Activity in terms of net new listings placed on the market increased 3.6% versus May 2023.

Throughout May, inventory continued to increase, as new homes flooded into the market in metros across the country. While inventory remains low from a historical perspective, total housing supply has continued to grow and is rapidly approaching high points seen in 2022, with total inventory up 22.3% from the same period in 2023. However, the interest rate shock is having the biggest impact on net new listing volume which remains sharply down year-over-year.

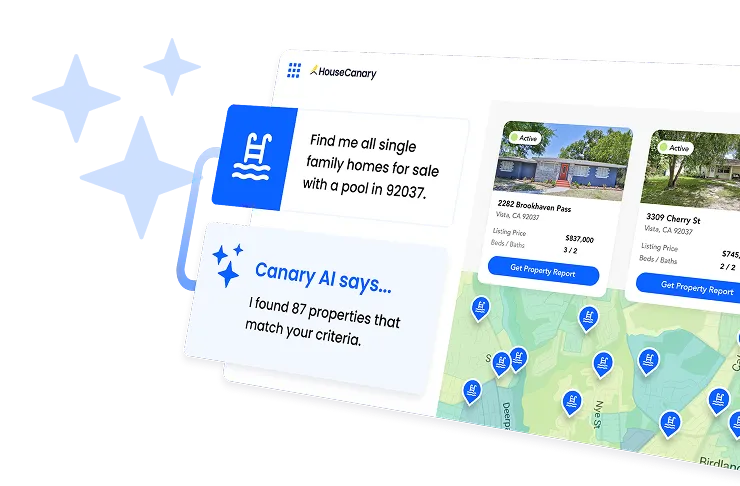

Jeremy Sicklick, Co-Founder and Chief Executive Officer of HouseCanary, commented:

Although inventory has continued to increase over the past four weeks, we’ve seen little relief in terms of home prices. With home prices reaching record highs throughout April and mortgage rates still hovering around 7%, homebuyers are continuing to feel the impact of high interest rates. First-time buyers have been particularly affected by rising home prices, as they struggle to break into a highly competitive housing market.

With mortgage rates still peaking, homeowners are also cautious of putting their homes up for sale and losing out on lower mortgage rates. This mortgage rate “lock-in” effect can be seen in a decrease in net new listings. Though total inventory has continued to rise, it's clear that buyers and sellers have yet to warm to the idea of jumping into the market. As we look ahead to June, the start of summer will likely remain somewhat quiet, as both hopeful homebuyers and those looking to sell have little incentive to enter the housing market.

Key Takeaways

- In the last year, net new listings and properties under contract decreased - Over the last 52 weeks, 2,617,925 net new listings were placed on the market, and 2,591,530 properties went under contract. This represents a decrease of 3.6% and 6.3%, respectively.

- YoY net new listings and properties under contract increased - For the month of May 2024, 313,719 net new listings were placed on the market, and 313,237 properties went under contract. This represents an increase of 2.8% and 3.3%, respectively, versus May 2023.

- The increase in net new listings was driven by a 5.5% increase in new listing volume as well as a 21.7% increase in removals compared to May 2023.

- Median days on market stands at 34. This is up 3.0% from where it was one year prior at 33 days on market.

- The median price of all single-family listings in the US was $458,026 and the median closed price was $438,497. On a year-over-year basis, the median price of all single-family listings is up 3.0% and the median price of closed listings is up 6.9%. Month-over-month, the median price of single-family listings is up 0.7% and the median price of closed listings is up 3.3%.

More in the full report.

Methodology

The Market Pulse Report is an ongoing review of proprietary data and insights from HouseCanary’s nationwide platform, covering 22 listing-derived metrics and comparing data between May2023 and May 2024.

.jpeg)