In today’s competitive mortgage landscape, loan officers need more than just traditional methods to stay ahead. Educating clients with real-time, comprehensive market data, such as home estimates and mortgage interest rates, can be a game-changer. Homebuyers, especially first-time buyers, seek reliable advice to navigate the housing market, making mortgage loan officers who offer actionable insights stand out as trusted advisors. Providing real-time data not only supports clients’ decision-making but also establishes loan officers as experts in their field.

This blog explores how mortgage loan officers can leverage HouseCanary’s CanaryAI, Property Explorer, and Market Insights to provide clients with up-to-date market information, including electronic valuations and the median home price across the U.S. Access to data on over 136 million properties nationwide helps loan officers guide clients on market trends, making the buying process smoother and ultimately increasing client trust.

The Importance of Staying Top-of-Mind with Clients

For mortgage loan officers, staying relevant and top-of-mind with clients means offering more than competitive mortgage interest rates. In a market overflowing with information, loan officers who add value by educating clients on current trends, including home estimates and median home prices in the U.S., gain a significant advantage.

Providing insightful, real-time market data, such as electronic valuations and property comparisons, helps clients make well-informed decisions. Whether it’s understanding home values, conducting a comparative market analysis, or gauging property turnover rates, offering these insights positions you as an essential resource. Leveraging AI-driven platforms that offer instant, reliable data is key to effectively educating clients and supporting their journey through the mortgage process.

Current Process and Pain Points

Traditionally, mortgage loan officers faced challenges accessing comprehensive, current market data. Many data sources are scattered, requiring time-intensive efforts to compile accurate information. This fragmented approach can lead to inaccuracies or outdated information.

A lack of integrated, real-time data creates missed opportunities to educate clients and provide relevant insights on median home prices or property values. Without updated data, clients may feel uncertain about their decisions, potentially delaying their mortgage process or property search. A streamlined, data-driven solution is essential for today’s loan officers.

Solution Overview: HouseCanary’s CanaryAI and Market Insights

HouseCanary’s innovative tools like CanaryAI and Property Explorer offer instant access to data on over 136 million properties, including real-time home estimates and electronic valuation insights. These tools equip loan officers to quickly pull relevant market data, analyze trends, and present clients with informed property insights.

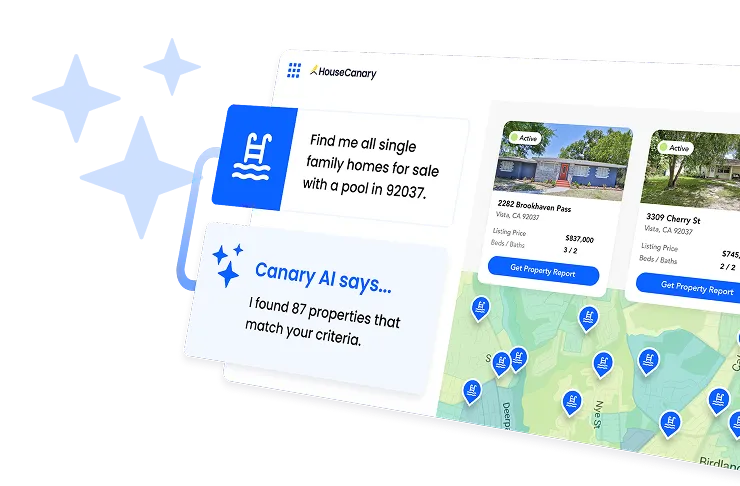

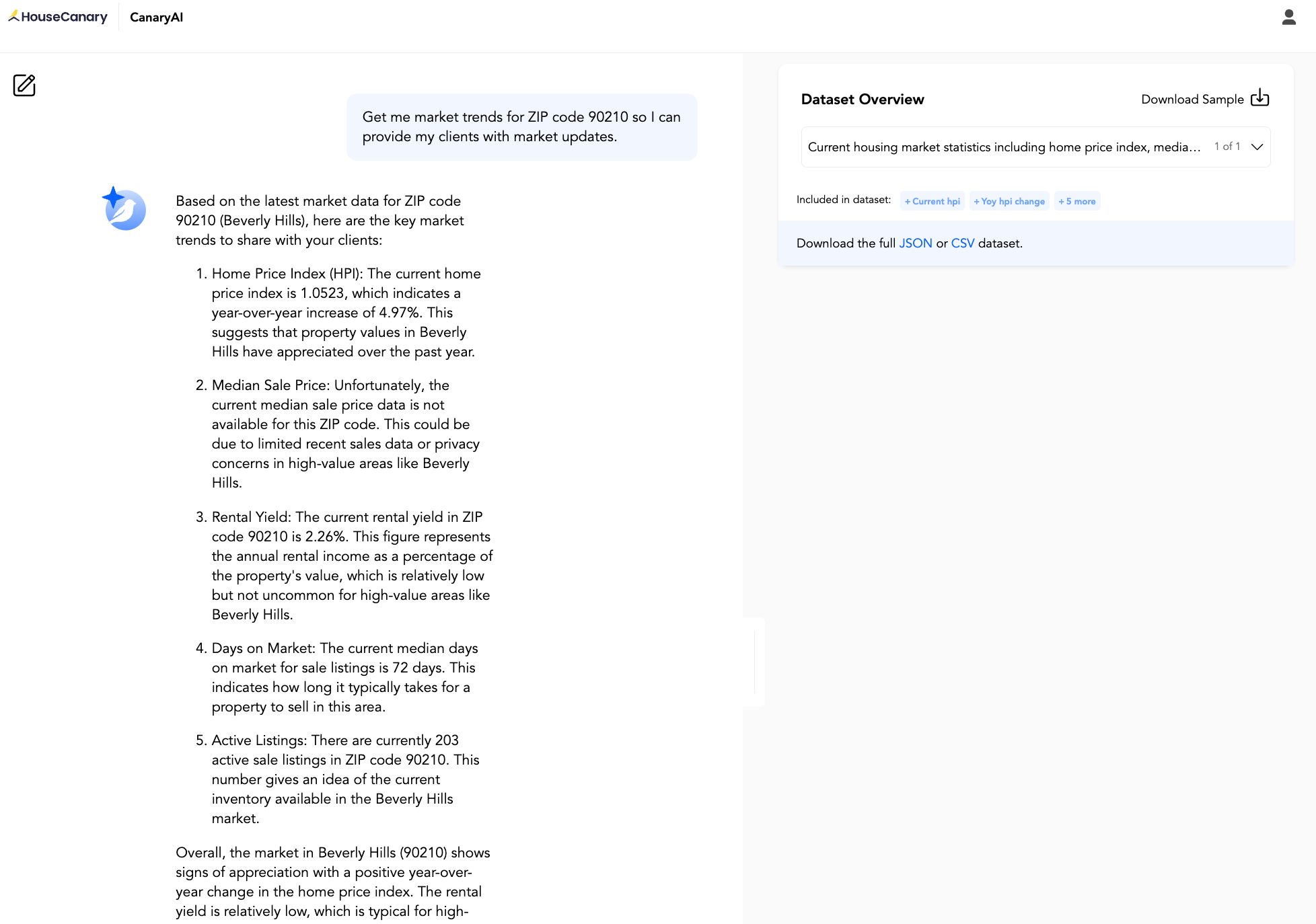

CanaryAI is an advanced, AI-powered solution that provides loan officers with instant access to property data, market trends, and mortgage interest rate analytics. With a few clicks, loan officers can create comprehensive reports that help clients understand housing market dynamics and trends.

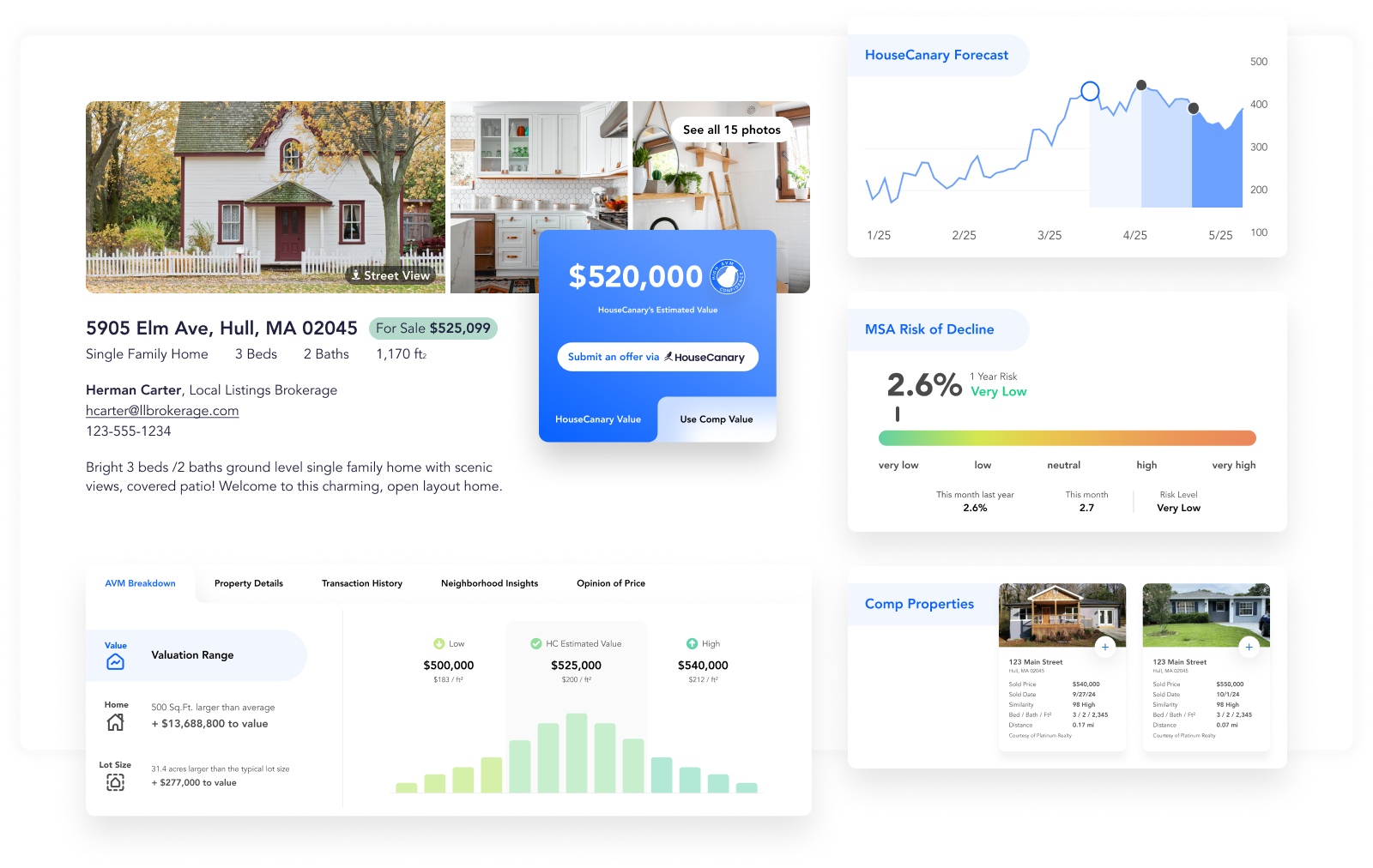

Property Explorer allows for in-depth property analysis across neighborhoods. It aggregates data from public records, MLS listings, and proprietary analytics, offering loan officers and their clients a complete view of the housing market.

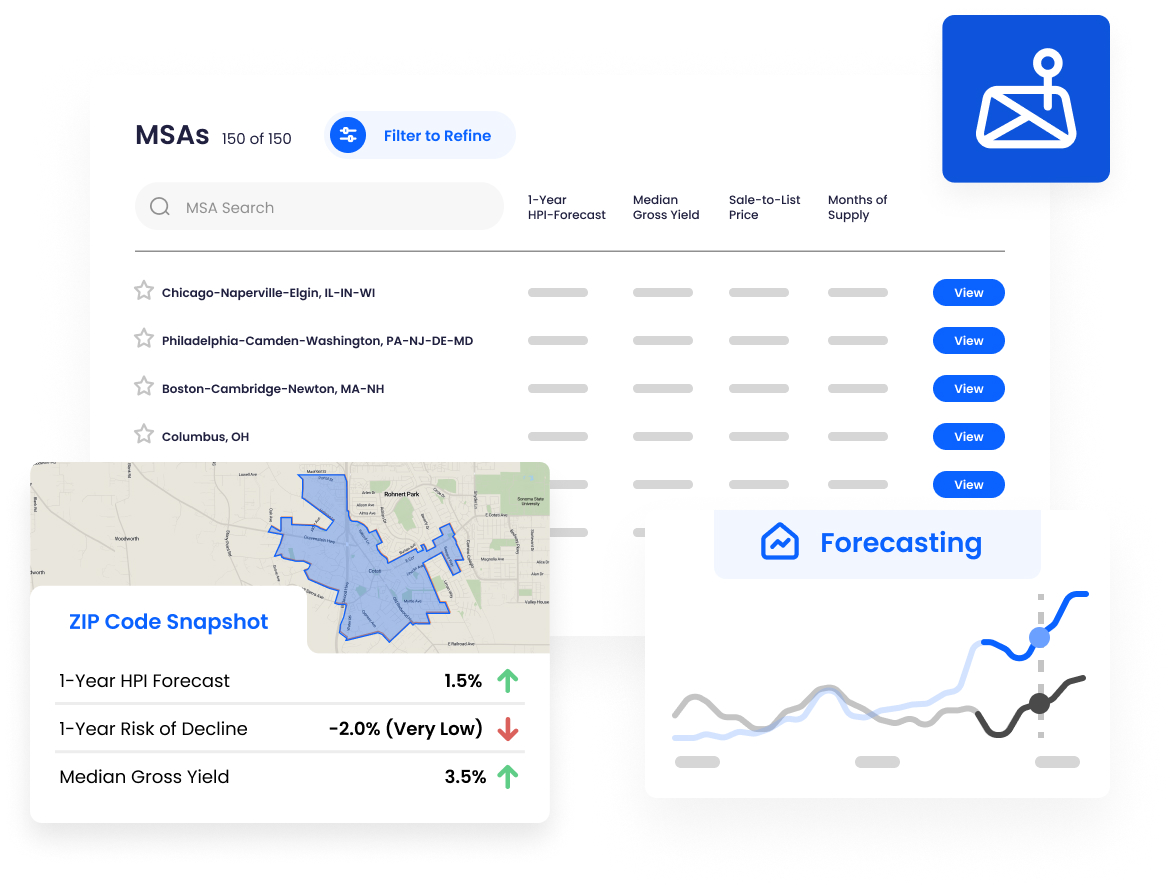

Market Insights delivers ZIP-level and MSA-level trends, enabling loan officers to assist clients in making data-driven decisions tailored to specific areas. This is especially valuable for clients evaluating neighborhoods based on median home price and other key indicators.

How It Works: Leveraging AI and Real-Time Data to Educate Clients

By using AI and real-time data, mortgage loan officers can guide clients on property values, trends, and market conditions. For instance, an electronic valuation can provide instant property assessments, offering clients a clear view of market standing and home estimate comparisons.

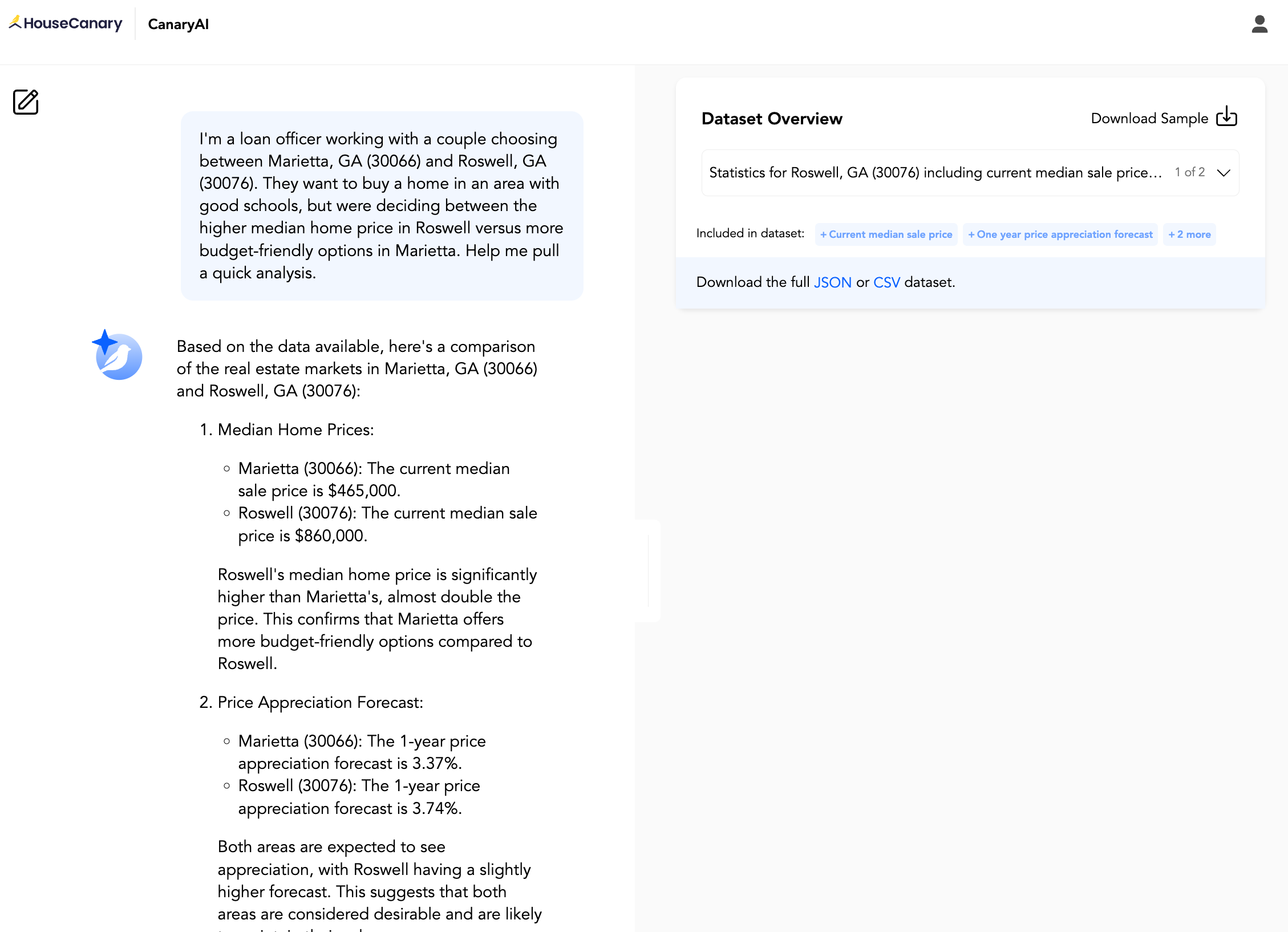

Consider this real-world example of a client consultation using HouseCanary’s CanaryAI:

Real-World Example: Jane’s Client Consultation

Jane, a loan officer, was working with a young couple choosing between Marietta, GA (30066) and Roswell, GA (30076). They wanted to buy a home in an area with good schools but were deciding between the higher median home price in Roswell versus more budget-friendly options in Marietta.

Jane used CanaryAI to pull a quick analysis, obtaining the following insights:

Jane provided a data-driven comparison, explaining that while Roswell offered a higher appreciation rate and competitive market conditions, Marietta presented a more affordable option. The couple valued this detailed comparison, which helped them feel confident about their decision.

The Power of Automated Valuation Models

Using Automated Valuation Models (AVMs) enables loan officers to deliver efficient and precise property valuations instantly. AVMs, which integrate real estate valuation software with AI, create rapid home estimates, benefitting both loan officers and clients.

Offering AVM-based property reports alongside traditional comparative market analysis gives a complete view of a property’s value. Integrating AVMs helps loan officers build trust by delivering data-backed recommendations and valuations that clients can rely on.

Benefits of Using Real-Time Market Data

Leveraging AI and real-time data tools, like HouseCanary’s CanaryAI and Property Explorer, provides loan officers with the resources to offer invaluable insights to clients, enhancing their decision-making process.

- Become a trusted advisor: Sharing real-time data, including median home price insights and electronic valuations, establishes loan officers as knowledgeable and trusted advisors.

- Improve client relationships. Share updates on market trends regularly--including information on mortgage interest rates and property insights--to build stronger connections with clients.

- Stay ahead of the competition: Using AI tools provides insights that help you stand out and attract more clients.

- Increase client engagement: Real-time data allows for frequent, meaningful client engagement, helping you remain relevant throughout the home-buying process.

- Faster client decision-making: With accurate, real-time data, clients can make faster, informed decisions, improving satisfaction and reducing the sales cycle.

-

Conclusion: Why Educating Clients with Real-Time Data Keeps You Top-of-Mind

In the mortgage industry, providing real-time, comprehensive market data elevates you from a transactional role to that of a trusted advisor. By utilizing HouseCanary’s CanaryAI, Property Explorer, and automated valuation model platforms, mortgage professionals can streamline their processes, strengthen client relationships, and differentiate themselves from competitors.

Clients are more likely to choose a loan officer who delivers valuable market insights, including electronic valuations and home estimates. By guiding clients with data, you ensure they make informed decisions and that you remain top-of-mind throughout their home-buying journey.

Get started.