.jpeg)

Each new investment in single-family rentals should be grounded in selecting the right market. In real estate investing, this can be relatively difficult due to the complexity of the market, the unavailability of data, and the large number of variables. Thankfully, platforms like HouseCanary’s CanaryAI and Market Insights simplify the identification and comparison of markets, making this task much easier for investors.

In this guide, we'll walk you through a step-by-step process to identify, evaluate, and compare the best markets for your next investment property using data analytics powered by HouseCanary.

Step 1: Identifying New Markets for Investment

Before researching markets, it’s essential to define your rental investment strategy. What kind of property are you looking for? What rental yield or appreciation in property prices do you require? Once this framework is set, you can start looking for markets that align with your investment goals.

Lack of Information: The Core Challenge

One of the biggest challenges investors face is a lack of reliable and comprehensive data to evaluate new markets. Investors often have to piece together information from multiple sources—public records, MLS data, and other fragmented datasets—which leads to incomplete insights about market dynamics and ultimately suboptimal decisions.

Solution: Instant Market Research

One of the biggest hurdles investors face is the lack of reliable and comprehensive data. Often, you’ll need to pull information from various sources like public records or MLS data, which can lead to incomplete insights and less-than-optimal decisions.

How to Instantly Research Markets

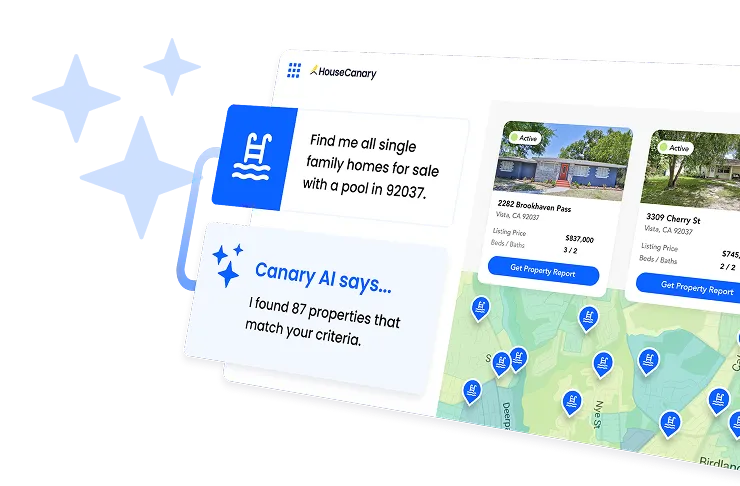

CanaryAI is a powerful tool for starting your market research. Instead of visiting multiple platforms, you can ask CanaryAI direct questions to quickly form an opinion of the markets. Here are a few examples:

- Know your market: Ask “How is the market for investment properties in Phoenix, AZ?” to get an overview.

- Compare markets: Ask “How does the investment market in Phoenix compare to Dallas?” to receive a direct comparison.

- ZIP code insights: Dive deeper by asking “How does 85006 compare to 85008 in Phoenix for investment properties?” for hyper-local data.

These questions offer a bird’s-eye view of potential markets, giving you an edge in aligning your investment strategy with optimal markets.

Step 2: Evaluating Market Conditions for Investment Properties

Once you have shortlisted a few markets, the next step is to analyze the conditions within each market more deeply with a real estate investment management software. Key metrics to consider include supply versus demand, rental rates, home pricing, and economic indicators such as employment growth.

Challenge: What to Look For

- Supply and demand: Measure housing inventory, new listings, and absorption rates. A high inventory with few sales may indicate weak demand or oversupply, which can drive down prices.

- Median home prices: Look at median prices over time. Consistently rising prices may signal an appreciating market but can reduce rental income potential if property prices rise too fast.

- Rental yields: Investors focused on cash flow need to find markets with high rental yields. CanaryAI can help by providing After Repair Value (ARV) estimates for specific properties.

Solution: Market Insights for In-Depth Analysis

HouseCanary’s Market Insights provides deeper, ZIP-level data analytics across over 14,000 ZIP codes and 200 MSAs. It offers approximately 100 key metrics, enabling you to:

- Track price trends: Understand how median prices of new, active, and closed listings are trending.

- Monitor supply vs. demand: Get insights into how long properties are staying on the market and the balance between new and removed listings.

- Assess rental trends: Get current data on rental rates, vacancy rates, and overall pricing trends in any specific market.

For example, you might use Market Insights to compare Phoenix neighborhoods, such as 85006 and 85008, and determine which has better long-term investment potential.

Step 3: Comparing Multiple Markets for Investment Properties

After evaluating individual markets, the final step is to compare them against each other to see which offers the best opportunities. This involves not only comparing current metrics but also forecasting future trends and understanding market-specific subtleties.

Factors for Comparison

- Stability: Examine the historical performance of home prices and rental income in each market.

- Future trends: Use CanaryAI and Market Insights for predictive analytics to forecast future property values and rental prices. Both tools provide projections up to three years ahead.

- Risk assessment: Analyze risks, including crime rates, economic conditions, and natural disaster risks. Comparing flood zones or earthquake risks, for example, can help in making risk-adjusted decisions.

Example: Comparing Phoenix with Dallas

To compare Phoenix and Dallas for real estate investments, you could use HouseCanary tools to assess the following:

- Home price growth: How have home prices in each market evolved over the past five years?

- Rental yield: What kind of rental income can you expect in Phoenix versus Dallas?

- Economic drivers: What industries dominate each market, and how does that affect its stability and growth prospects?

These insights allow you to make data-driven decisions rather than relying on assumptions.

Step 4: Taking Action and Investing in Real Estate

Once you've identified the best markets using housing market predictions, it’s time to zero in on individual properties within those markets. HouseCanary’s Acquisition Explorer and Property Explorer tools can assist with this stage.

Finding Opportunities

Acquisition Explorer helps investors swiftly source on- and off-market opportunities. You can create “Buy Boxes” to filter and be alerted to properties that meet your investment criteria. Detailed MLS listings and proprietary data further streamline the process of finding properties that fit your portfolio.

Property Valuation and Comparison

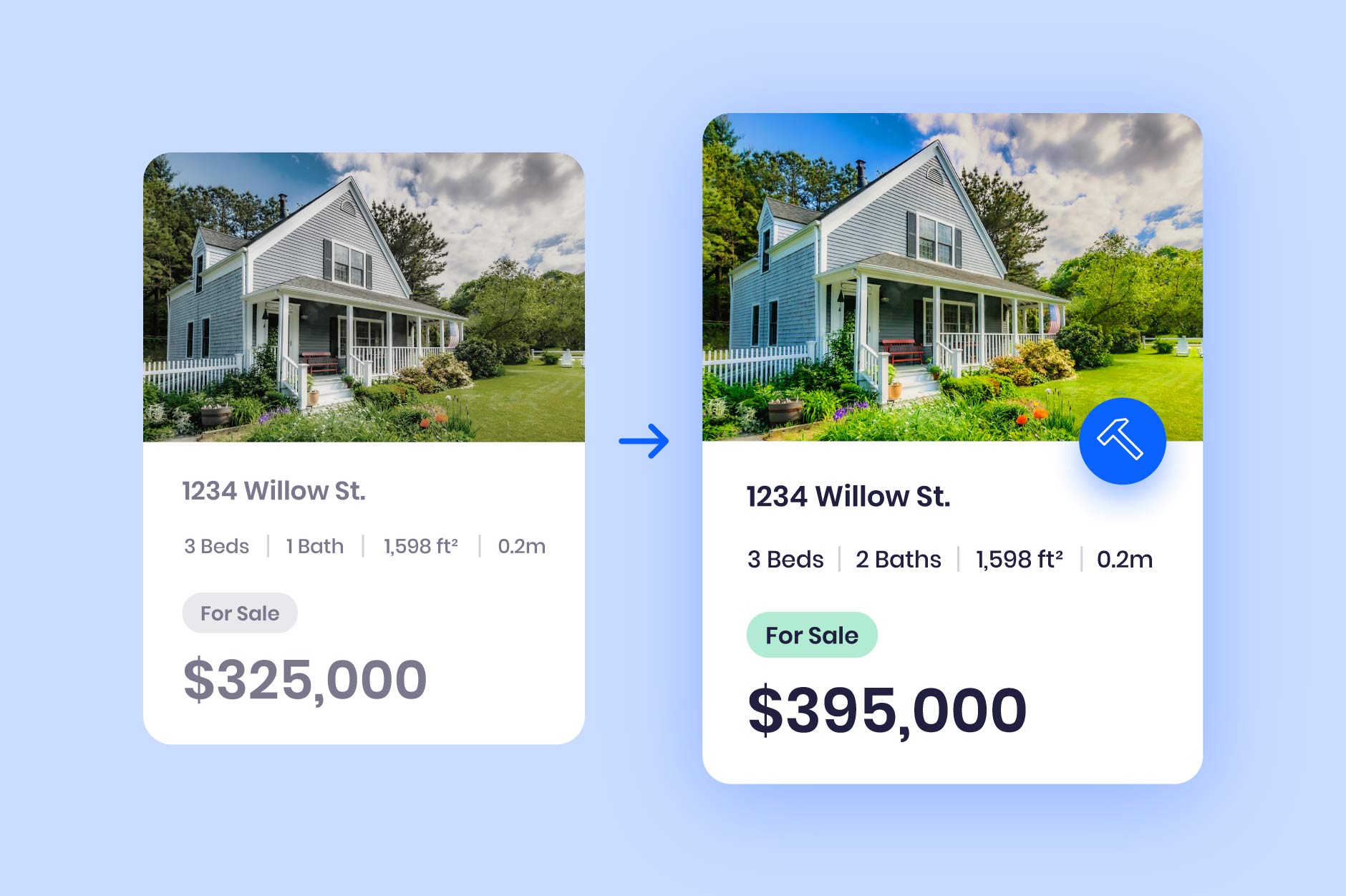

Once your target market is defined, Property Explorer offers a dynamic desktop valuation report and comp selection tool for evaluating and comparing properties. It mines a database of over 110 million properties, combining public records and MLS data to provide a comprehensive profile of each property.

With this tool, you can compare properties, estimate post-repair value, and get insights into rental income potential. Property Explorer also helps assess neighborhood trends and risks.

Conclusion: Empower Your Real Estate Investment with Data

In today's competitive real estate investment landscape, access to the right data is critical. Tools like HouseCanary's CanaryAI and Market Insights provide investors with comprehensive views of potential markets, ensuring confident, data-driven decisions. Identify, evaluate, and compare markets effectively, empowering your next steps in building a profitable rental investment strategy.

Whether you're exploring markets like Phoenix or Dallas, HouseCanary's tools give you the insights needed to ensure no investment opportunity is missed.

Get started.

.jpg)