As a real estate investor, whether you're managing a single rental property or a portfolio of single-family rental (SFR) properties, maximizing cash flow is one of your highest priorities. However, ensuring your rental properties consistently generate optimal income can be a challenge—especially if you don’t have a streamlined way to track rental rates, monitor housing market forecasts, and set the right prices across multiple properties.

In this blog, we'll explore how you can optimize cash flow by using data-driven strategies, leveraging advanced tools like HouseCanary’s CanaryAI, Property Explorer, and Portfolio Monitoring. These tools can help you benchmark rental rates, track changes in the real estate market, and optimize rental pricing, so you stay competitive and maximize gross income.

1. Benchmark Rental Rates Using Rental AVMs

One of the most crucial steps in maximizing cash flow is setting the right rental price for your properties. If you're relying on guesswork or outdated information, you could be either undercharging and missing out on income or overpricing and risking longer vacancy periods.

HouseCanary’s Rental AVM (Automated Valuation Model) uses real-time market data and machine learning to accurately estimate the potential rental value of any property. The model factors in rental comparables, market conditions, unique property features, and historical data to deliver the most accurate rental price possible.

Understanding Rental AVMs and Their Impact on Cash Flow

Rental AVMs offer a scientific approach to setting rental prices, moving away from traditional methods that often involve subjective estimations. By relying on data-driven models, you minimize the risk of human error and ensure that your rental prices reflect true market conditions. This accuracy is crucial because even small pricing discrepancies can accumulate over time, significantly affecting your overall cash flow.

With a Median Absolute Prediction Error (MdAPE) of just 1.83% and a hit rate of 99%, you can be confident that your rental pricing is right on target, maximizing both gross income and occupancy.

Actionable Tip:

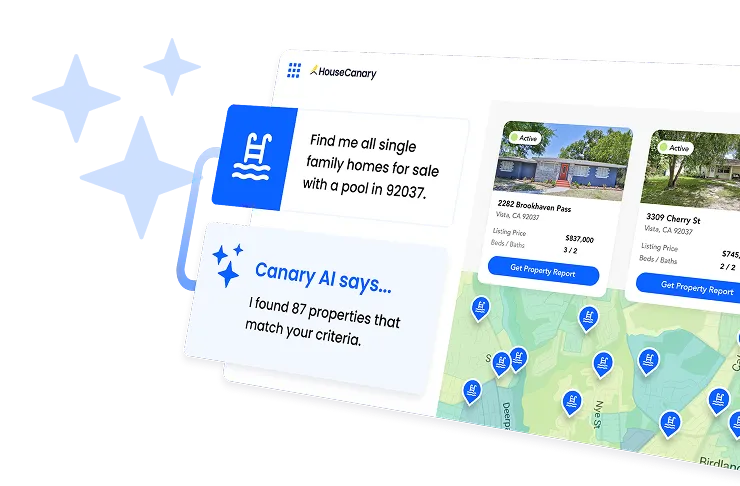

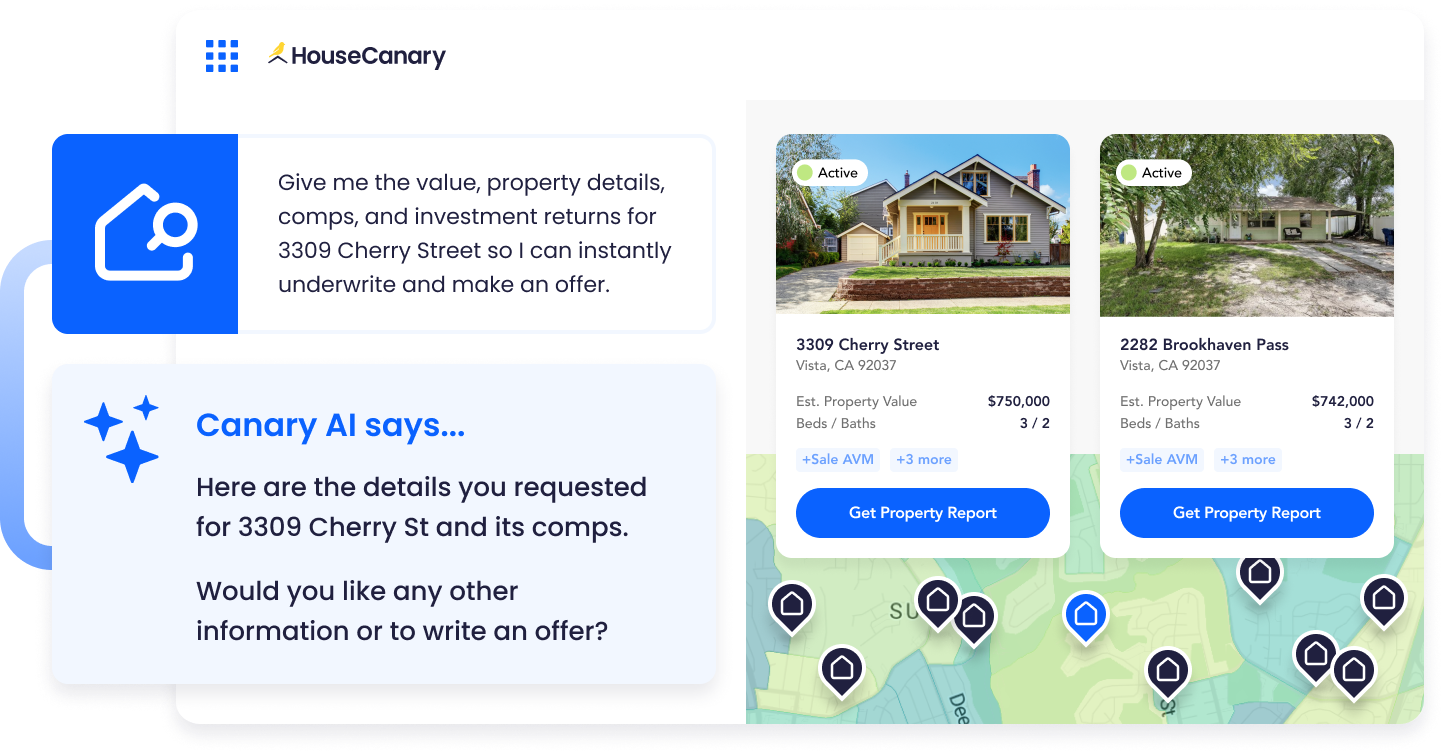

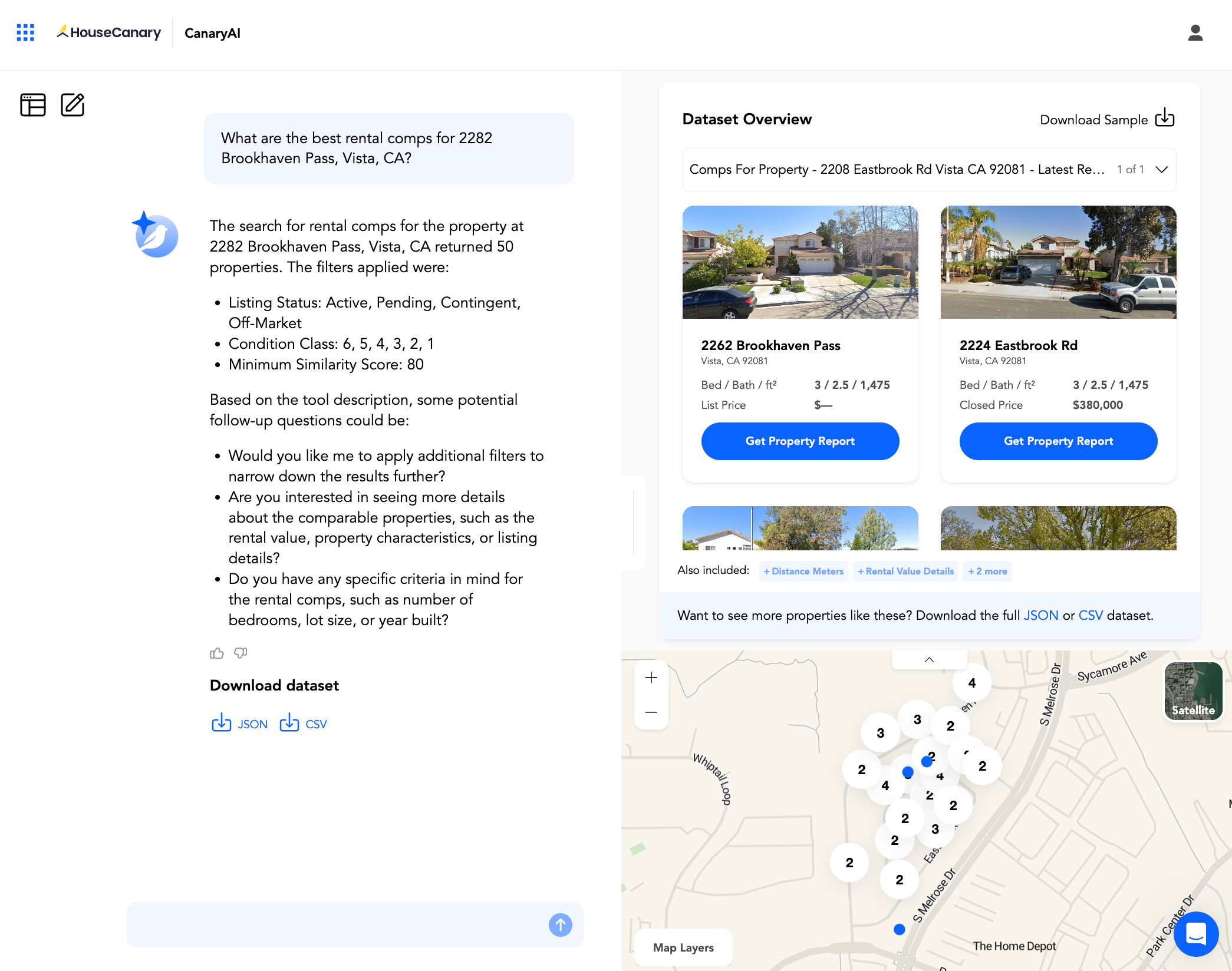

Take advantage of CanaryAI by asking key questions such as "What is the rental value of 123 Main Street, Atlanta?" or "What are the best rental comps for 123 Main Street?" This will give you an immediate snapshot of whether your current rent is aligned with the market.

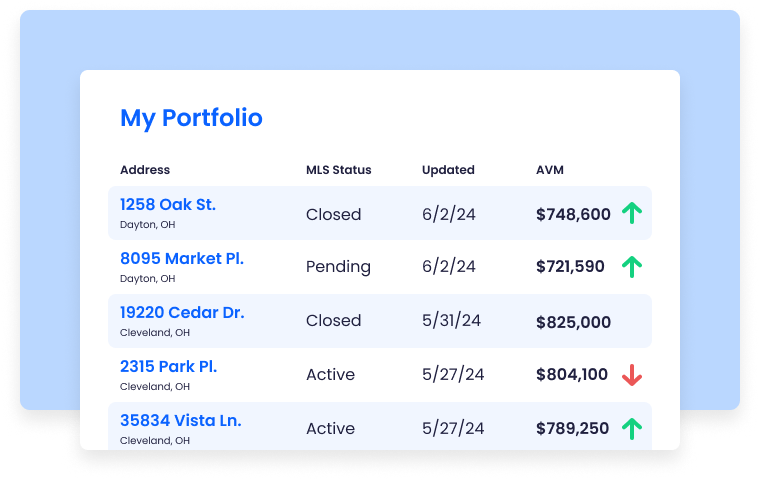

2. Track Market Trends Using Data Explorer Portfolio Monitoring

Rental markets are constantly shifting due to various factors such as interest rate fluctuations, changes in property taxes, local economic developments, and variations in neighborhood desirability. As a real estate investor, it's crucial to stay informed about these changes to ensure your rental pricing remains competitive and aligned with current market conditions.

Understanding the Impact of Market Trends on Rental Pricing

Market trends can significantly affect rental demand and pricing. For example, an increase in local employment opportunities may lead to a surge in demand for rental properties, allowing you to increase rents. Conversely, a rise in property taxes or an economic downturn could necessitate more conservative pricing strategies to maintain occupancy rates.

To effectively navigate these fluctuations, it’s essential to understand the broader economic and demographic trends influencing your specific rental markets. This includes tracking metrics like population growth, employment rates, and new housing developments. By doing so, you can anticipate changes in rental demand and adjust your pricing strategy accordingly.

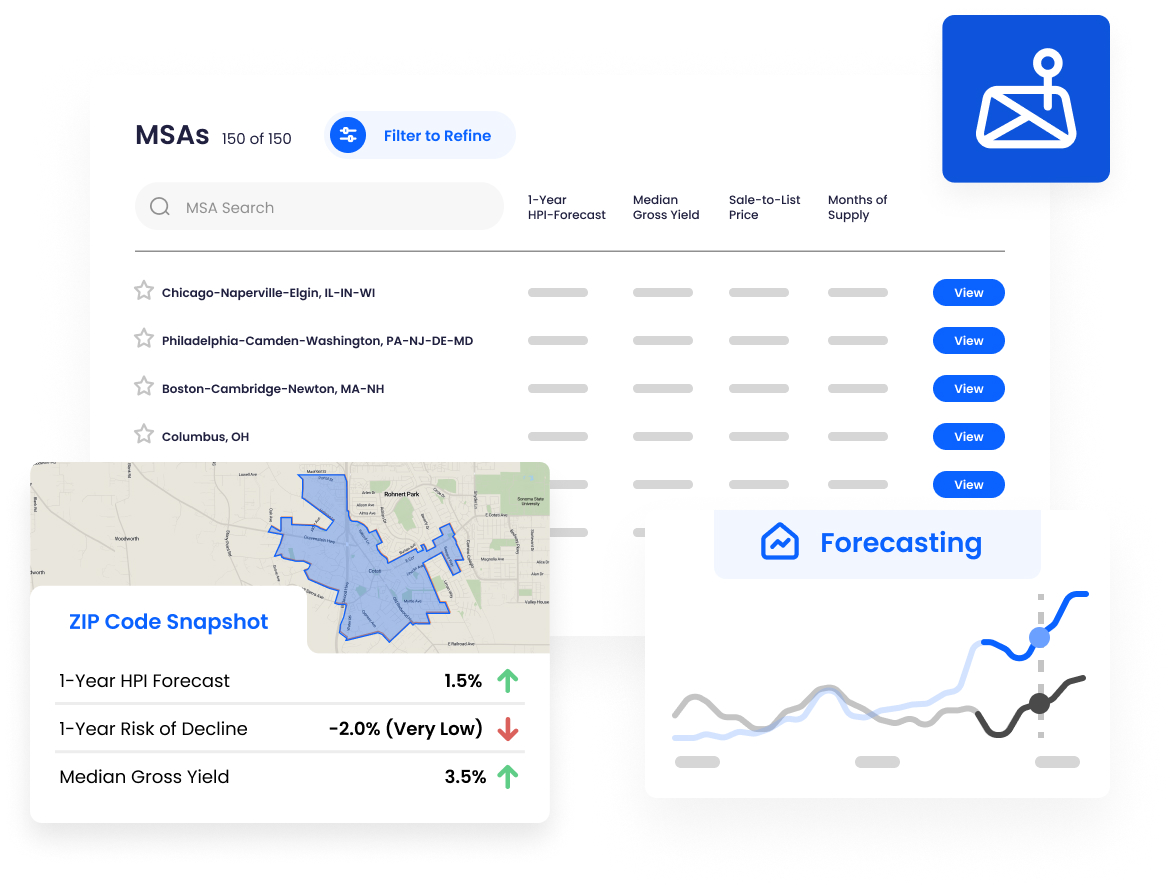

HouseCanary’s Data Explorer and Portfolio Monitoring tools provide you with real-time access to market data that is crucial for making informed decisions. These tools allow you to monitor key indicators such as:

- Rental rate trends: By tracking the average rental prices in your area, you can identify whether your rents are competitive or if adjustments are needed.

- Market appreciation: Understanding the rate of property value appreciation in your markets can inform decisions on whether to raise rents or consider selling underperforming properties.

- Occupancy rates: Monitoring the average occupancy rates can help you assess the demand for rental properties in your area and adjust your strategy to minimize vacancies.

For example, if you notice a trend of increasing rental prices in a neighboring area, you might anticipate a spillover effect into your market. Adjusting your rental rates preemptively can help you capture higher rents before the broader market catches on. Similarly, if you observe declining rents in a nearby market, you can strategize on how to retain tenants by offering competitive pricing or additional amenities.

Actionable Tip:

Use Market Insights to monitor rental values for similar properties in your area. By staying on top of these trends, you can adjust your pricing before market conditions shift too dramatically.

3. Optimize Rents for Long-Term Stability

While maximizing cash flow is crucial, you also need to balance rent optimization with tenant retention. High turnover rates increase vacancy costs, raise maintenance expenses, and consume more time. Striking the right balance between maximizing rents and retaining long-term tenants can stabilize your cash flow and minimize costs.

Balancing Rent Increases and Tenant Satisfaction

It’s important to recognize that aggressive rent increases might boost short-term cash flow but could lead to higher turnover rates, ultimately reducing long-term profitability. Retaining long-term tenants provides financial stability, reduces vacancy periods, and minimizes maintenance costs. To achieve this balance, understanding your tenants’ needs and the competitive landscape is key.

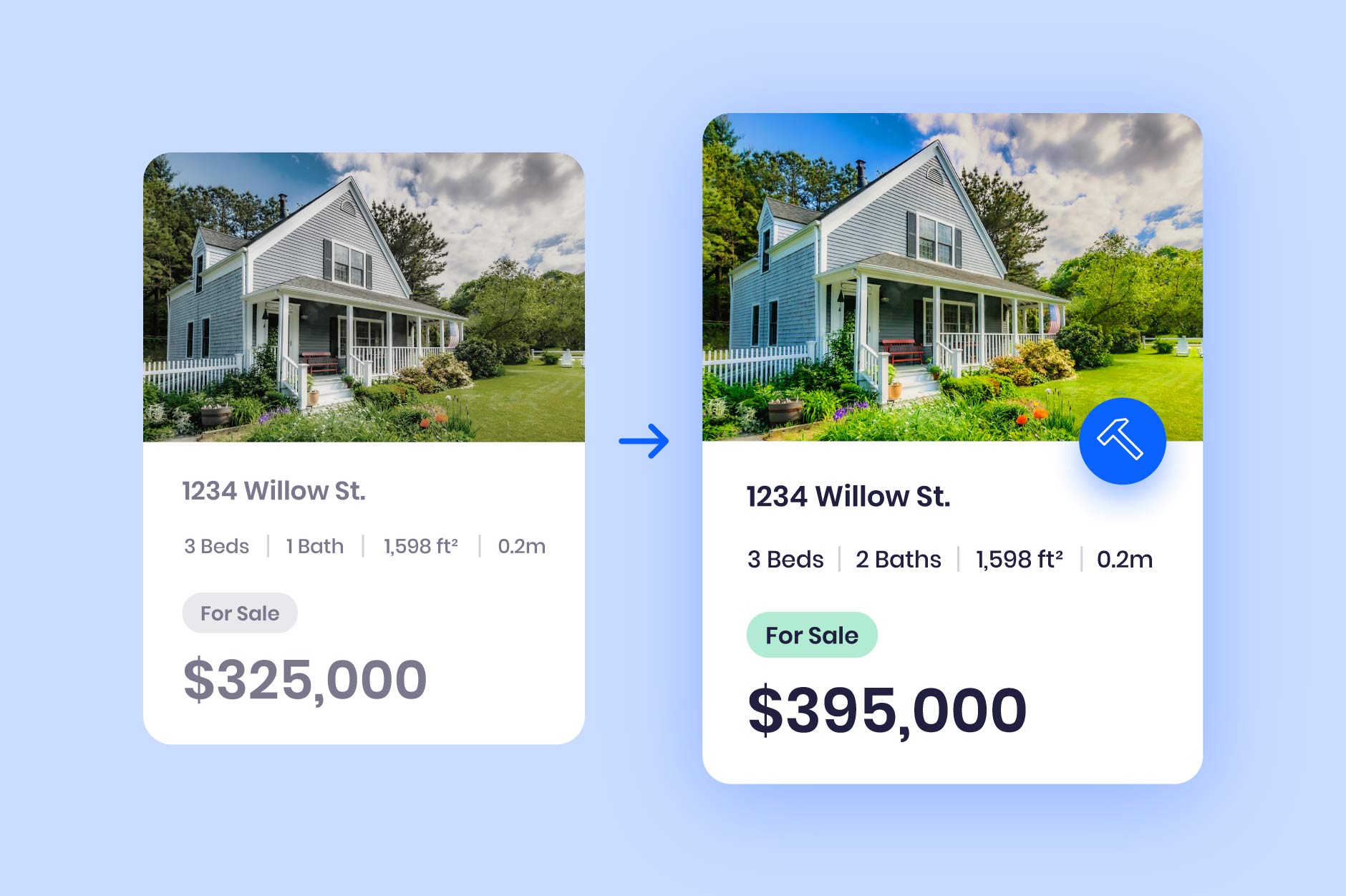

HouseCanary’s Property Explorer helps you analyze your properties and compare rents with similar listings. You can use this data to adjust your prices without alienating long-term tenants, ensuring you maintain consistent rental income while reducing turnover.

Actionable Tip:

Use CanaryAI and Property Explorer to identify properties with rent prices significantly below market rates. Consider gradually increasing rents to better align with market rates, while keeping long-term tenants satisfied.

4. Leverage Rental Comparables for Competitive Pricing

In any rental market, pricing your properties competitively is key to minimizing vacancies and maximizing cash flow. Setting rents too low means you're losing income, but pricing them too high can result in longer vacancy periods.

The Importance of Competitive Pricing

Competitive pricing is not just about matching market rates; it’s about understanding the unique value proposition of your property compared to others. Factors such as location, amenities, and property condition all play a role in determining how your rental stands against similar properties. By carefully analyzing these factors, you can set a rental price that attracts high-quality tenants while ensuring maximum occupancy.

HouseCanary’s Rental AVM helps you stay competitive by providing real-time rental comparables. This allows you to quickly adjust your rental prices to reflect changing market conditions. Accurate pricing attracts high-quality tenants and reduces the risk of prolonged vacancies, which can significantly impact your bottom line.

Actionable Tip:

Use CanaryAI and Property Explorer regularly to check the latest rental comparables for each property in your portfolio. This ensures you’re pricing correctly and can make adjustments before leases renew.

5. Automate Portfolio Management to Save Time and Maximize Efficiency

Managing multiple rental properties can be time-consuming and challenging, especially as your portfolio grows. Manually tracking each property’s performance, reviewing market data, and adjusting rental prices can quickly become overwhelming.

The Role of Automation in Portfolio Management

Automation in portfolio management not only saves time but also reduces the likelihood of human error, which can occur when manually tracking data across multiple properties. By automating routine tasks such as rent adjustments, market monitoring, and performance tracking, you can focus more on strategic decision-making and less on administrative tasks.

HouseCanary’s Portfolio Monitoring tool automates many of these tasks, providing you with regular updates on your portfolio’s performance. With just a few clicks, you can access detailed data on current rental values, recent market trends, and updates on property taxes or maintenance costs. This allows you to make timely adjustments that maximize cash flow without the need for manual tracking.

Actionable Tip:

Automate tracking for your entire portfolio using Portfolio Monitoring. This ensures you stay updated on market changes and rental values without the need for time-consuming manual effort.

6. Monitor Property Expenses to Protect Profits

While optimizing rental income is critical, monitoring expenses such as property taxes, maintenance costs, and insurance is equally important. These costs can quickly erode your profits if not carefully managed.

Balancing Income and Expenses for Sustainable Profitability

Effective expense management involves more than just tracking costs; it requires a proactive approach to identifying potential issues before they become costly problems. For instance, regular property inspections can help you catch maintenance issues early, preventing expensive repairs down the line. Additionally, understanding your properties' tax liabilities and potential increases can help you plan rent adjustments accordingly.

Visit the property yourself or order HouseCanary Exterior BPOs that include an inspection to monitor potential future expenses by assessing the health of each property and predicting potential issues. This helps you set rents that not only cover costs but also provide healthy returns.

Actionable Tip:

Regularly review your expense reports and compare them with projected rental income to ensure maintenance costs and property taxes are factored into your cash flow strategy.

7. Leverage Technology to Maximize ROI

Investing in real estate is more data-driven than ever. Gone are the days of manually tracking rental rates and estimating property values based on gut feelings. Tools like CanaryAI and Property Explorer automate many aspects of property management and rental rate optimization, helping you make smarter, data-driven decisions.

By utilizing these technologies, you not only save time but also increase your ROI by ensuring your properties are priced correctly and performing at their best.

The Power of Technology in Real Estate Investment

Modern technology has revolutionized real estate investment by providing investors with tools that offer unprecedented levels of accuracy and efficiency. By leveraging AI and data analytics, you can gain insights that were previously difficult or impossible to obtain, allowing for more precise and profitable decision-making. This technological edge not only enhances your ability to optimize rents but also streamlines overall property management, leading to higher returns on investment.

By utilizing these technologies, you not only save time but also increase your ROI by ensuring your properties are priced correctly and performing at their best.

Actionable Tip:

Explore the full range of HouseCanary’s platform to see how these technologies can help you maximize rental income and streamline property management across your portfolio.

Conclusion: Streamline Your Cash Flow Strategy

Maximizing cash flow across your SFR portfolio requires ongoing analysis, consistent tracking, and timely adjustments to rental pricing. With tools like CanaryAI, Property Explorer, and Portfolio Monitoring, you can effectively optimize your rental income, reduce vacancies, and ensure your properties are always competitive in the market.

Start making smarter decisions today with HouseCanary’s suite of solutions, and see how precise rental AVMs and rich market insights can drive your bottom line.

Get started.

.jpg)

.jpeg)