In the competitive world of real estate investing, proactive asset management is essential for profitability and long-term success. The fluctuating nature of property values, interest rates, and market conditions can significantly impact your portfolio, making continuous performance tracking a critical component for staying ahead. By identifying underperforming properties early, you can avoid poor returns, increasing expenses, and even potential losses. This is where solutions like HouseCanary’s Portfolio Monitoring step in, empowering investors with the tools to make informed, strategic decisions.

The Challenge: Continuous Monitoring of Assets

A major challenge many real estate investors face is the difficulty of continuously monitoring the performance and health of a property portfolio, whether it's 5, 25, or hundreds of properties. Manually tracking each property’s value, rent performance, and market trends can be overwhelming and resource-intensive. With so many moving parts—monthly rent, property taxes, interest rates, and more—keeping a pulse on underperforming assets is a tough task for even the most seasoned investors.

With so many moving parts, such as monthly rent, purchase price, and property appreciation, it’s easy to lose sight of underperforming assets. Technology now provides an easier way to stay on top of your portfolio, and HouseCanary’s Portfolio Monitoring is designed specifically for this purpose.

Understanding the Challenges of Manual Monitoring

Manually monitoring a real estate portfolio often leads to delays in identifying underperforming properties, which can result in lost income and increased expenses. The complexity of managing numerous properties means that small issues can go unnoticed until they become significant problems. This lack of timely data can hinder your ability to make quick, informed decisions that could improve the performance of your investments.

This is where technology plays a pivotal role in helping investors stay ahead of the curve. By leveraging advanced tools, such as HouseCanary’s Portfolio Monitoring, real estate investors can easily monitor performance, identify underperforming properties, and take timely corrective action.

Proactive Asset Management

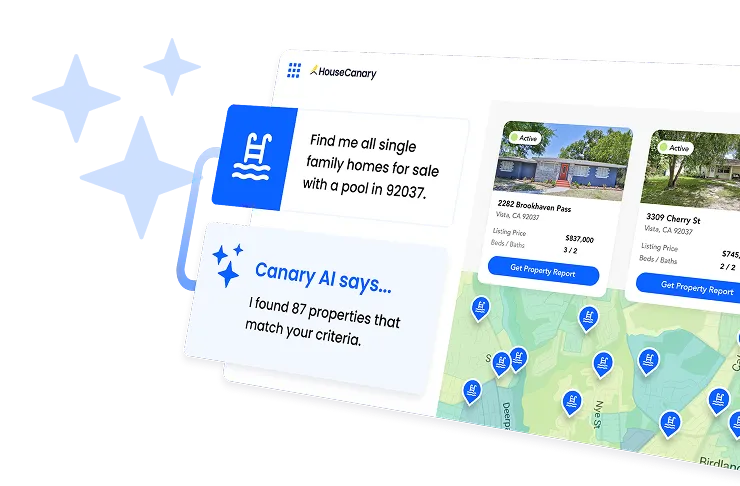

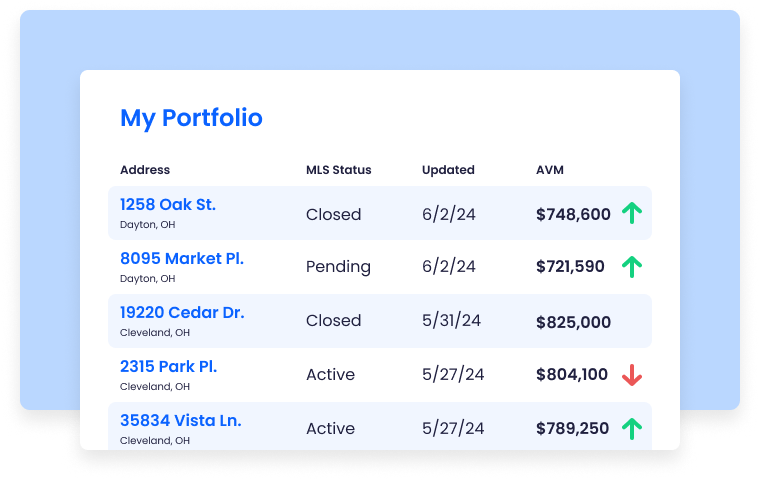

HouseCanary’s real estate investment platform, including Portfolio Monitoring, offers a comprehensive, real-time view of the performance of your assets. This solution provides instant updates on key metrics, such as automated valuation models (AVMs) and rental values. With this level of insight, investors can take timely corrective action to mitigate risk and enhance profitability.

Here’s how HouseCanary's real estate investor platform benefits real estate investors:

- Accurate property valuations: Portfolio Monitoring provides updated AVMs for each property, giving investors a clear understanding of the current home value estimate based on market conditions. This data ensures you are aware of the appreciating or depreciating trends of each property in your portfolio. (Explore more about AVMs and how they work.)

- Real-time alerts: With real-time notifications, you can track critical metrics like AVM and LTV changes, ensuring you act quickly when a property’s performance falters. This function is especially valuable for identifying properties with high LTV ratios, which may indicate a riskier financial position. (Learn how Portfolio Monitoring can streamline your asset management.)

- Tracking rental value: Investors can monitor rental values in comparison to market rental comps. This ensures rents are adjusted to meet current market rates, maximizing rental income. Setting the right rent can drastically improve the cash flow of your portfolio. (Get real-time rental comps with Property Explorer.)

- Comprehensive market health metrics: HouseCanary’s platform offers more than just property-level data. It provides a detailed overview of market conditions, including forecasted home price appreciation and rental price appreciation. This broad perspective helps investors make informed decisions about property disposition. (Find out how Data Explorer can help analyze market trends.)

Identifying Underperforming Properties

One of the most significant advantages of Portfolio Monitoring is its ability to help investors spot underperforming properties. By analyzing factors like declining home price appreciation, poor rental performance, or increasing maintenance costs, investors can determine when to sell a property and reinvest the capital in better opportunities.

Key Metrics for Identifying Underperformance

Identifying underperforming properties early allows you to avoid prolonged periods of low returns and reinvest capital into more promising assets. Key metrics such as cap rate, home price appreciation, rental performance, and loan-to-value ratios provide critical insights into a property's financial health. Watching these metrics helps you spot underperformance before it significantly impacts your overall portfolio returns.

Key metrics to watch for include:

- Cap rate: This measures a property’s net operating income relative to its purchase price. If the cap rate falls below your target, it might be time to evaluate the property’s performance.

- Home price appreciation: A property that isn’t appreciating as expected might be better off sold, especially if the local real estate market is slowing down. HouseCanary’s real estate investor platform provides forecasts for home price appreciation, allowing you to anticipate market changes. (Track market health and appreciation trends.)

- Rental performance: If your rental income is consistently below market value or isn’t keeping pace with forecasted rent growth, the property might be underperforming. In this case, adjusting the rent or selling the property may be the best course of action.

- Loan-to-Value (LTV) ratio: A high and increasing LTV ratio suggests you are over-leveraged and could be at risk in a market downturn. Monitoring this metric allows you to take corrective action before it’s too late.

Taking Corrective Action

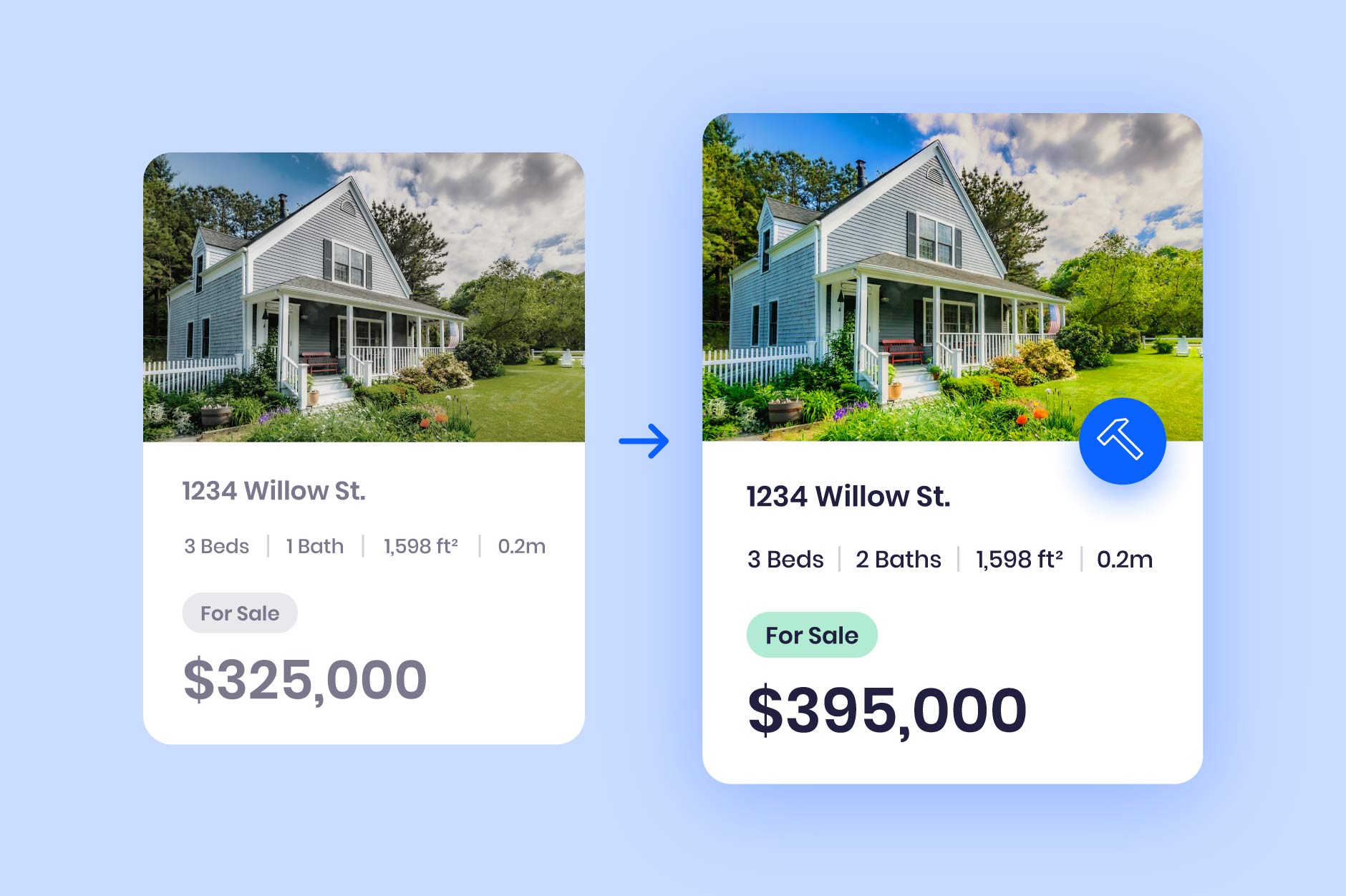

Once underperforming properties are identified, the next step is to take corrective action. If a property’s value or rental income is declining, you can decide whether strategic improvements can increase performance or if it’s time to sell the asset.

Strategies for Enhancing Property Performance

When addressing underperformance, the first step is to determine whether the issue is temporary or systemic. Temporary issues might be resolved through targeted actions like renovations, rent adjustments, or improved property management. However, if a property consistently underperforms, it may be more prudent to sell and reinvest the proceeds in higher-yielding assets. Understanding the root cause of underperformance is crucial to deciding on the appropriate corrective action.For properties that have the potential to improve, consider the following corrective actions:

- Renovations or upgrades: Small improvements, such as energy efficiency upgrades or adding desirable amenities, can boost property value and rental income. This can bring an underperforming asset back on track.

- Adjusting Rent Prices: Setting a competitive rent price can help attract more tenants, reducing vacancy rates and increasing cash flow. HouseCanary’s Property Explorer allows investors to compare rental comps and set the optimal rent. (Discover how to adjust rent prices with Property Explorer.)

For properties that no longer fit your investment strategy, selling may be the best option. In these cases, HouseCanary’s services offer additional benefits:

- Market timing: By providing insights into local market conditions, HouseCanary helps investors choose the right time to sell a property. This ensures that you maximize the return on your investment while avoiding potential losses in a down market.

- Streamlined disposition: As a licensed real estate brokerage in all 50 states, HouseCanary can help facilitate fast and discounted disposition of assets to other investors. This enables investors to reinvest capital into higher-return opportunities more quickly. HouseCanary’s Brokerage Services can facilitate fast and discounted disposition, enabling you to reinvest capital in higher-return opportunities.

The Value of Continuous Monitoring

Success in real estate investing hinges on making timely, informed decisions. Without continuous monitoring, investors risk holding onto properties that are no longer profitable or missing out on opportunities to optimize their returns. By leveraging a proactive approach, Portfolio Monitoring helps investors stay ahead of potential issues, ensuring the portfolio is always performing at its best.

Long-Term Benefits of Continuous Monitoring

Continuous monitoring is not just about reacting to immediate changes; it's about building a long-term strategy that enhances your portfolio's resilience to market fluctuations. By regularly assessing property performance and market conditions, you can make proactive adjustments that improve your portfolio's overall health. This approach helps you avoid the pitfalls of market volatility and ensures that your investments continue to meet your financial goals.

The benefits of continuous monitoring through tools like HouseCanary’s Portfolio Monitoring include:

- Reduced risk: By identifying properties with high LTV ratios, declining values, or poor rental performance, investors can reduce financial risk and avoid potential losses.

- Increased profitability: Timely adjustments to rents or disposition of underperforming properties can help investors maximize their monthly rent income and overall returns.

- Efficient decision-making: HouseCanary’s platform provides real-time data and insights, allowing investors to make quick, data-driven decisions that enhance their portfolio’s performance.

- Strategic reinvestment: Once underperforming properties are sold, investors can reinvest their capital into better-performing assets, improving their portfolio’s overall return on investment.

Actionable Tips:

HouseCanary’s suite of solutions, including Portfolio Monitoring, offers real estate investors a comprehensive solution to track, analyze, and manage their portfolios. With access to detailed property data, AVMs, and rental comps, investors can stay ahead of the market, proactively manage assets, and optimize their returns.

- Portfolio Monitoring: Track asset performance, identify underperforming properties and take corrective action, and determine disposition timing with proactive alerts on key metrics like AVM value and LTV changes.

- Agile Insights: For investors needing fast and accurate property valuations, Agile Insights provides contextual property valuations that help assess the market value of individual properties.

- Property Explorer: A desktop valuation report and comparable selection tool that helps investors underwrite and assess credit or equity risk in single-family rental properties.

-

Conclusion: Take a Proactive Approach with HouseCanary

In today’s fast-paced real estate market, proactive asset management is essential to success. By utilizing tools like HouseCanary’s Portfolio Monitoring, investors can continuously track performance, identify underperforming properties, and take timely corrective actions. This approach helps reduce risk, increase profitability, and make data-driven decisions that optimize long-term returns.

Don’t wait until a property is underperforming to take action. Start using HouseCanary’s Portfolio Monitoring and other tools today to proactively manage your real estate investments.

Get started.

.jpg)

.jpeg)