December brought a mix of seasonal trends and evolving market dynamics. While net new listings hit multi-year lows, buyer demand persisted, especially in the mid-to-upper price tiers. With inventory rising and prices showing steady year-over-year growth, the housing market continues to adapt to shifting conditions.

In December 2024, 100,916 net new listings were placed on the market, a significant 20.5% drop compared to December 2023. Yet, contract volumes climbed by 5.6%, fueled by strong activity in the $400k-$1m+ price ranges. This growth highlights ongoing buyer demand despite challenges like reduced listing activity, economic uncertainty, and elevated interest rates.

"December’s data highlights a balancing act," said Jeremy Sicklick, Co-Founder and CEO of HouseCanary. "While rising inventory eases some supply pressure, seasonal lows in listings paired with resilient buyer activity showcase the market’s adaptability. These dynamics will play a crucial role as we move into 2025."

Key Highlights from December 2024

1. Inventory Growth Signals a Shift

Inventory levels are up 24.6% compared to December 2023, marking their highest point since pre-pandemic times. While total supply remains below historical averages, this growth reflects a gradual easing of constraints.

2. Buyer Activity Stays Strong

Despite lower listing activity, contract volumes grew by 5.6% year-over-year, with the $600k-$1m and $1m+ price tiers leading the charge. Mid-to-high price properties continue to dominate buyer interest.

3. Prices Reflect Resilience

The median listed price for single-family homes in December 2024 was $433,350, up 2.5% year-over-year. The median closed price saw even stronger growth, rising 6.5% to $415,792. While month-over-month changes showed slight declines, annual trends reveal steady buyer demand across most segments.

4. Rental Market Insights

Rental inventory surged by 23.4% compared to last year, with the median listed rent stabilizing at $2,511 (+0.5% year-over-year). This increased supply is helping balance rental price pressures as we head into 2025.

Breaking It Down by Price Tier

- $0-$200k: Listings and contracts remain sluggish, with contract volume down 0.2% year-over-year.

- $200k-$400k: Steady growth, with contracts up 4.4%.

- $400k-$600k: Strong gains, contracts rose 5.4%.

- $600k-$1m: Significant momentum, contracts surged 11.5%.

- $1m+: Leading the market with a 12.7% rise in contracts.

What This Means for 2025

The December 2024 Market Pulse Report highlights a housing market in flux. Rising inventory and resilient buyer demand signal a gradual transition toward a more balanced market. However, the sharp drop in new listings underscores lingering challenges in supply.

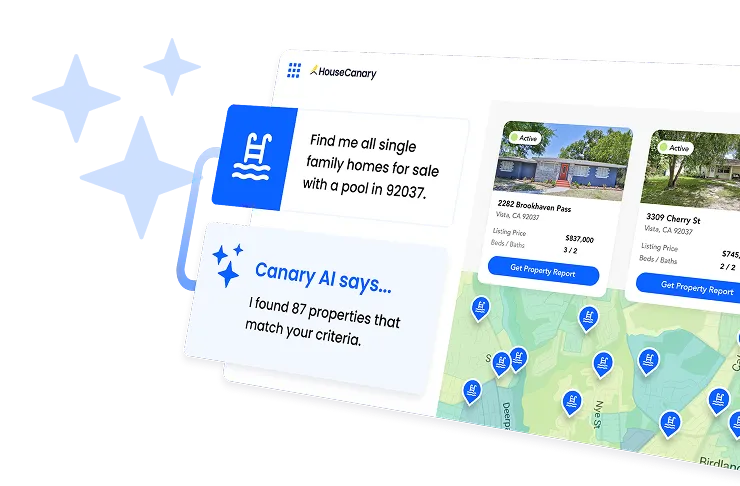

To navigate these complexities, data-driven decision-making is critical. HouseCanary’s insights empower investors and real estate professionals to adapt to market shifts with confidence.

More in the full report.

Methodology

The Market Pulse Report is an ongoing review of proprietary data and housing market trends from HouseCanary’s nationwide platform, covering 22 listing-derived metrics and comparing real estate data between December 2023 and December 2024.

.jpeg)