The world of single-family rentals (SFR) is abuzz as AI begins to penetrate PropTech. From computer vision for assessing property conditions to highly accurate valuations, AI is beginning to touch every aspect of the real estate lifecycle. But amidst the hype, it's important to remember: the core principles of SFR investment remain the same.

The original real estate adage: location, location, location

While AI excels at crunching data, the fundamental importance of location can't be overstated. Strong local economies, good schools, and desirable amenities continue to be key drivers of rental demand and property value. HouseCanary's MSA and ZIP level analytics, powered by AI, can help you identify areas with these qualities.

Understanding market trends and not just numbers

Forecasting data like Home Price Index (HPI) and Rental Price Index (RPI) provide forward-looking insights into market trends. However, understanding the "why" behind the numbers is equally important. MSA and ZIP level analytics in our Market Insights reports delve deeper, analyzing economic factors, and local nuances that can influence market performance.

The human touch of tenant relationships

Technology can automate tasks and streamline processes in SFR investing, but it can't replace the human touch. Building strong relationships with tenants is fundamental for long-term success. Here's why:

- Finding quality tenants: Technology can help screen potential tenants, but a human touch is crucial for assessing character and ensuring a good fit for your property.

- Handling maintenance requests: Responsive and efficient maintenance is essential for tenant satisfaction. While technology can facilitate communication, human interaction fosters trust and builds rapport.

- Fostering positive relationships: Investing in good relationships with tenants leads to long-term occupancy, reduced turnover, and potentially higher rental income.

AI is only as good as the data it’s trained on

While AI promises to revolutionize SFR investing, it's crucial to remember that all forms of AI are only as effective as the data they're trained on. HouseCanary’s AI is built on a foundation that prioritizes this very principle. Today, we have access to more data than ever before and, with that, our constant north star are four key pillars of data that ensure our models return the most accurate and current responses.

- Unmatched density: Our property database is the most comprehensive in the nation, covering over 114 million residential properties. This vast amount of data allows our AI models to identify complex patterns and make more nuanced valuations.

- Superior quality: We are a 50-state brokerage, which means we have access to 35 years of historical data. This data is meticulously normalized and enhanced with cutting-edge image recognition technology.

- Time-tested reliability: We have a proven track record and incorporate extensive historical data, which allows our AI models to learn from market trends over time, providing more accurate analytics in dynamic markets.

- Currency: Our data is updated daily, which ensures you're navigating the market with the latest information. This constant flow of fresh data allows our AI models to stay updated amid market fluctuations.

Leveraging the best of both worlds

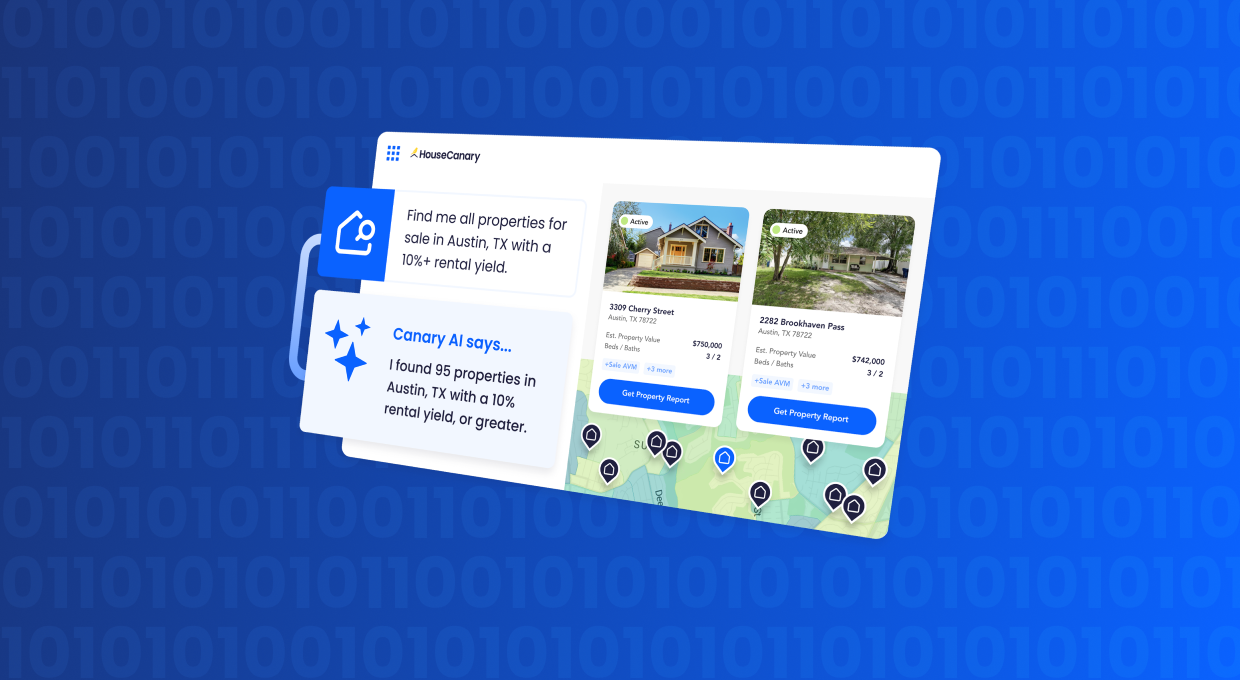

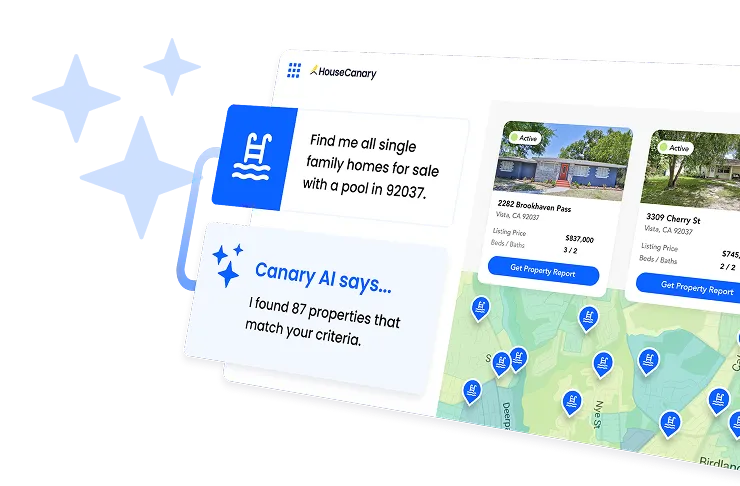

At HouseCanary, AI in real estate is nothing new to us. Our solutions have leveraged AI technology since our inception and we’ve always believed in harnessing the power of AI to enhance, not replace, traditional SFR investment strategies. Our suite of solutions empowers you to:

- Streamline your workflow: Leverage our real estate data API or bulk property data to access and analyze market data efficiently.

- Make informed decisions: Use our SFR property search with valuations, combined with market insights, to identify high-potential properties.

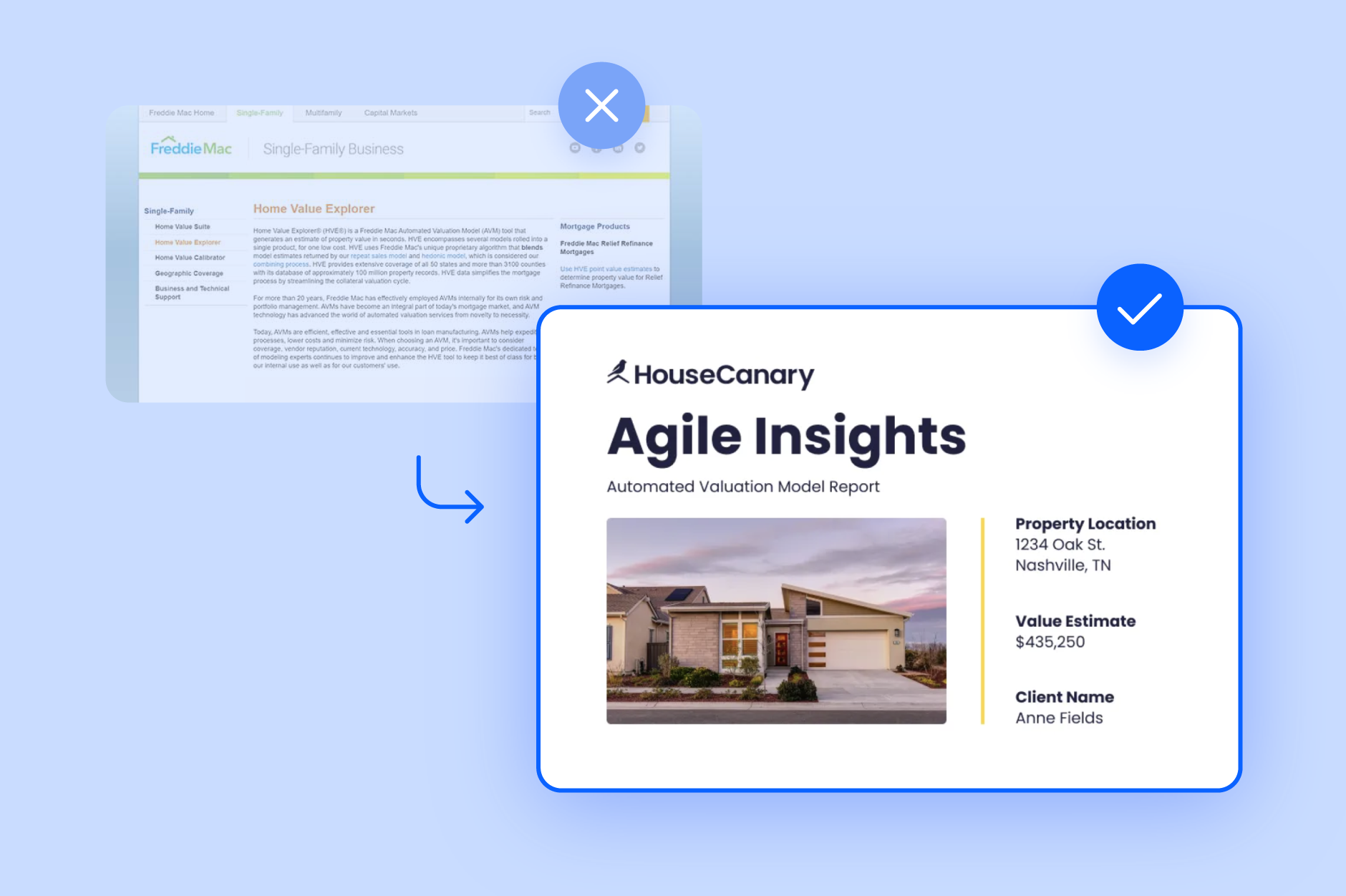

- Gain a competitive edge: Stay informed with AVMs and track market trends with HPI & RPI data.

- Monitor your portfolio: Simplify performance tracking with Portfolio Monitoring.

- Save time and resources: Generate automated valuation reports or request custom valuation reports for in-depth analysis.

By combining the power of AI with the enduring principles of SFR investing, you can navigate any market conditions with confidence.

Start with HouseCanary's real estate investment platform.

.png)

.jpeg)