In today’s fast-paced mortgage lending landscape, loan officers need speed and precision more than ever. Evaluating home values quickly and accurately is critical for meeting client demands and staying competitive. Yet, traditional methods like manual appraisals and broker price opinions (BPOs) often lack real-time insights, slowing down the underwriting process and increasing the risk of inaccuracies.

AI-powered home value tools on the HouseCanary Platform, such as CanaryAI, Property Explorer, and BPO, are transforming the underwriting process by combining advanced data analytics, machine learning, and real-time market data. These tools empower loan officers to make faster, more reliable decisions using precise home value estimators and calculators.

Current Challenges in Traditional Home Valuations

Mortgage underwriting traditionally relies on manual processes, which can introduce delays and inconsistencies. Common pain points include:

- Inconsistent valuations: Different appraisers or BPO providers may produce varying house values, causing confusion and delaying loan approvals.

- Time-consuming: Manual home appraisals can take several days or even weeks, creating bottlenecks.

- Limited data: Without comprehensive, real-time data, traditional methods struggle to forecast home values or recognize market trends accurately.

These issues frustrate clients and delay loan processing. AI-powered home value calculators offer solutions to these challenges, providing accurate and instant property valuations.

AI-Powered Home Value Solutions

HouseCanary’s suite of AI-driven tools, including CanaryAI, Property Explorer, Agile Insights, and BPO, expedite underwriting by delivering real-time home values, detailed market insights, and high-confidence home value estimations:

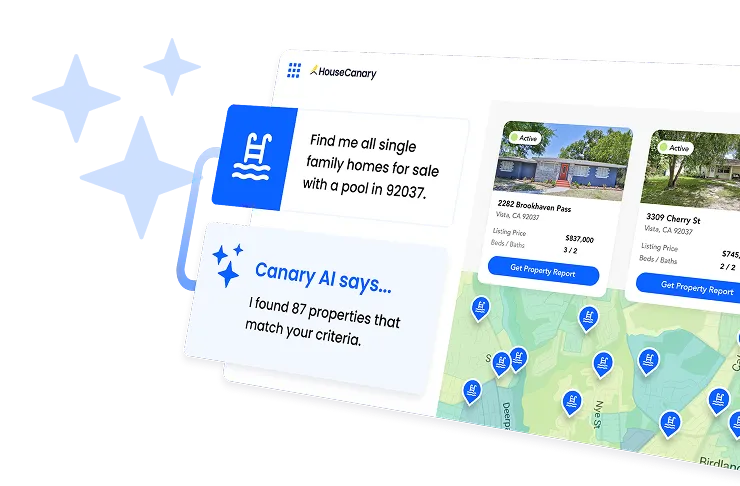

- CanaryAI: Offers instant home value calculations by analyzing MLS data, public records, and comparable sales for accurate and fast property assessments.

- Property Explorer: Generates comprehensive property reports, including valuations, conditions, and market comparables, so loan officers can perform real-time property analysis.

- Agile Insights: Provides insights into market trends and neighborhood conditions to support data-driven decision-making.

- BPO: Combines AI-driven data with expert broker insights for precise, timely house value estimates.

How AI-Powered Home Value Calculators and Estimators Work

AI-powered property valuation tools use machine learning to analyze large datasets. They provide real-time home value calculations that are more accurate than traditional methods. These systems gather data from many sources, like MLS listings, public records, and market trends, to create accurate valuations.

- Data collection: AI tools for real estate agents collect data from public records, comparable sales, and real estate trends.

- Real-time valuation: CanaryAI calculates home values in real time, allowing loan officers to act quickly.

- Forecasting: AI-powered models predict future home values, helping loan officers assess long-term market risks.

- Comparative Market Analysis: Property Explorer enables users to adjust for variables like property condition, location, and size for more accurate valuations.

Case Study: AI-Enhanced Underwriting for Quicker Loan Approvals

Consider Jane, a mortgage loan officer helping clients choose their ideal home. With CanaryAI, Jane quickly compared the two properties her clients were interested in:

- Property characteristics: Size, layout, and amenities were analyzed instantly for each property.

- Condition and estimated value: The home value estimator revealed that 1065 Laurian Park Dr. was valued higher, largely due to its larger size and better condition.

- Neighborhood data: Both homes were in similar school districts, but neighborhood crime data gave an edge to one property over the other.

- Market forecast: One home showed a high likelihood of listing soon, helping Jane advise her clients on the best timing for an offer.

With AI-driven insights, Jane’s clients made quick, informed decisions. This helped them avoid delays and missed opportunities.

The Benefits of AI-Powered Home Value Tools in Underwriting

Jane’s experience highlights the benefits of using AI-powered home value calculators and estimators in underwriting:

- Faster underwriting: Tools like CanaryAI and Property Explorer reduce the time needed for valuations, enabling more responsive service.

- Increased accuracy: AI-driven home value estimations analyze vast datasets for precise results.

- Data-driven decisions: Loan officers gain the confidence to make informed decisions backed by real-time market data.

- Scalability: AI solutions make it easy to manage multiple property valuations without sacrificing accuracy or speed.

Conclusion: Why AI is Key to Underwriting Efficiency

AI-powered home value tools are revolutionizing mortgage underwriting by offering faster, more accurate valuations. Solutions like CanaryAI, Property Explorer, and Agile Insights empower loan officers to streamline processes, improve decision-making, and close deals faster. By leveraging AI, loan officers can move beyond traditional methods and confidently meet client needs with reliable, data-backed insights.

Discover how AI-powered home value calculators can enhance your underwriting efficiency.

Get started.